Department of Labor's New Overtime Rules

Stay compliant. Let EasyClocking help your business through this transitional period

The Fair Labor Standards Act (FLSA) and changes to overtime rules.

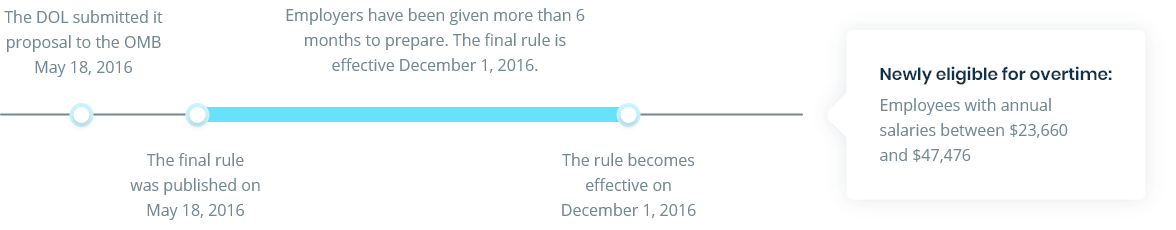

Are you prepared for the changes coming December 1, 2016? The Department of Labor recently published changes to overtime policy which will significantly change employee overtime eligibility salary thresholds. With upwards of 4.2 million workers to become eligible for overtime under this new policy change, it’s imperative that you find a system to managing your employee data.

Which of your employees will be eligible?

How do the FLSA Changes affect me?

Changes to overtime policies under the FLSA will affect your salaried employees of your organization whom:

Meet job duties exemption requirements and have a salary ranging from $23,660 and $47,476 per year.

Meet the Highly Compensated Employee (HCE) job duties exemption requirements and have a salary ranging from $100,000 and $134,004 per year.

How can I comply with these new FLSA overtime Changes?

There are 2 possible methods to FLSA overtime compliance:

A. Transition newly non-exempt employees to hourly and pay overtime rates.

B. Increase salary compensation of newly non-exempt employees to proposed minimum.

The Daily Post EasyClocking’s eye on industry news & updates.

We stay up to date on changes that could affect your business!

The Fair Labor Standards Act (FLSA), also known as the federal Wage and Hour Law, regulates minimum wage, overtime, equal pay, recordkeeping, and child labor. Under the FLSA, employees are classified as either exempt or non-exempt from minimum wage and overtime. Some states and local jurisdictions have their own wage and hour laws, which may provide greater protection for employees than what is provided under the FLSA.

The FLSA applies to virtually all businesses, including public agencies, and regardless of size.

Not necessarily. To be classified as exempt, employees must meet all of the following requirements:

- Paid on a salary basis

- Paid a salary that meets or exceeds the minimum requirement

- Paid their full salary in any work week in which they perform work

- Perform specific job duties that are considered executive, administrative, professional, computer, or outside sales

These exemptions are sometimes referred to as “white collar” exemptions. They are determined by an employee’s specific job duties. Each of these exemptions have their own set of requirements, which can be found on the Department of Labor’s website here.

How does EasyClocking help you stay compliant?

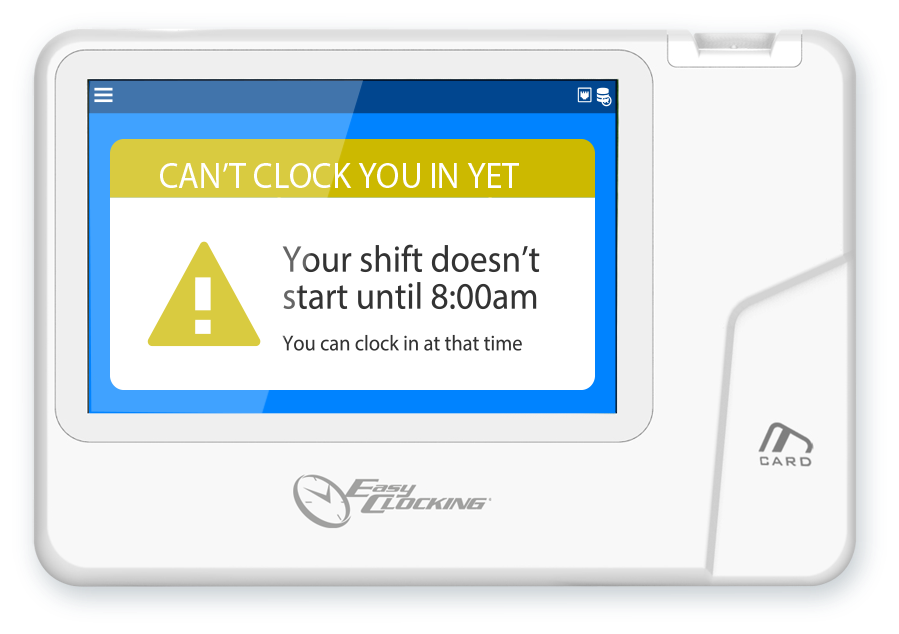

Punch Restriction

Restrict employee clock-in’s and outs, protect your business from unscheduled overtime of employees. Effectively manage your employee clock-in times by prohibiting out of shift punches and restricting early or late shift clock-in’s.

Overtime Management

Easily comply to present and future overtime laws. Configure rules and setting to aid your business in staying compliant.

- Configurable double time policies.

- Configurable overtime policies by specific days or weeks.

- Applicable OT policies to individual employees, departments, or shifts.

- Easily comply to various local, state, or nationwide OT rulings.

Powerful Reporting

Gain complete visibility with EasyClocking’s reporting solutions. Get real time employee data to making informed business decisions.

- Overtime reports for specific details on employee overtime.

- Real time data analytics for better decision making.

- Filter reports by location, departments, or employee status.

Customizable Schedules

Manage labor costs through EasyClocking’s scheduling feature. Set schedules for easy management of employee schedules.

- Effectively manage and oversee labor usage.

- Set employee or departmental specific schedules.

- Manage contractors and part time employee schedules.